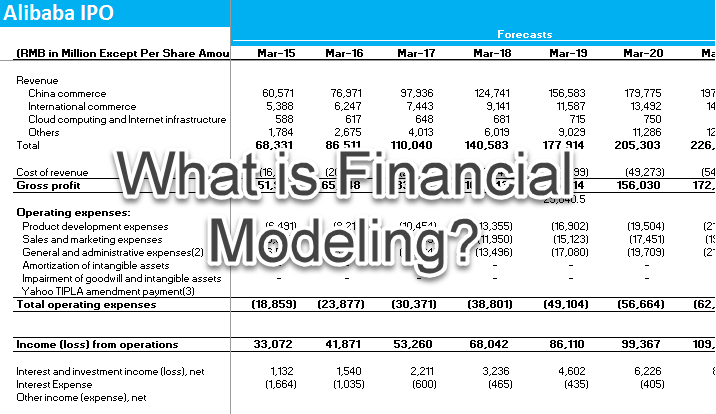

Financial modeling is the process of creating mathematical representations of a company’s financial performance. It involves forecasting future financial outcomes based on historical data, assumptions, and various economic factors. Financial models are essential tools for businesses as they provide insights into potential outcomes, aid in strategic planning, and support informed decision-making.

Importance of Financial Modeling

Importance:

- Decision-Making: Financial models help businesses evaluate various scenarios and make informed decisions based on their potential financial impact.

- Strategic Planning: By projecting future financial performance, financial models assist in developing long-term strategic plans and setting achievable goals.

- Risk Management: Financial models enable businesses to assess and mitigate financial risks by identifying potential challenges and developing contingency plans.

- Stakeholder Communication: Financial models facilitate communication with stakeholders by presenting complex financial information in a clear and understandable format.

- Performance Evaluation: Financial models help businesses monitor and evaluate their financial performance against predefined targets and benchmarks, allowing for adjustments and improvements as needed.

Overview of Different Types of Financial Models

a. Financial Statement Models: These models analyze historical financial statements (income statement, balance sheet, cash flow statement) to project future performance and assess financial health. They often include ratio analysis and trend analysis to identify patterns and trends.

b. Valuation Models: Valuation models determine the intrinsic value of a company or an asset based on various valuation techniques such as discounted cash flow (DCF), comparable company analysis (CCA), and precedent transactions analysis (PTA). These models are used in mergers and acquisitions, investment analysis, and determining the fair value of assets.

c. Budgeting and Forecasting Models: Budgeting and forecasting models help businesses develop financial plans and predict future performance based on revenue projections, expense forecasts, and capital expenditure plans. These models assist in resource allocation, goal setting, and monitoring financial performance against budgets.

d. Scenario Analysis and Sensitivity Models: These models assess the impact of different scenarios and variables on financial outcomes. They help businesses understand the potential risks and uncertainties associated with various decisions and develop strategies to mitigate them.

e. Capital Budgeting Models: Capital budgeting models evaluate investment opportunities and determine the feasibility and profitability of capital expenditures, such as expansion projects, acquisitions, and new product developments. These models use techniques like net present value (NPV), internal rate of return (IRR), and payback period analysis to assess investment decisions.

f. Risk Management Models: Risk management models quantify and analyze financial risks, such as market risk, credit risk, and operational risk. They help businesses identify potential threats to financial stability and develop risk mitigation strategies to protect against adverse outcomes.

Step-by-Step Guide to Building a Financial Model

Define Objectives: Clearly define the objectives of the financial model, including what decisions or analyses it will support. Determine the scope of the model, such as forecasting revenue, evaluating investment opportunities, or assessing the financial impact of strategic initiatives.

Gather Data: Collect relevant historical data and inputs needed for the financial model. This may include financial statements (income statement, balance sheet, cash flow statement), market data, industry benchmarks, and assumptions about future performance.

Identify Key Drivers: Identify the key drivers that will influence the financial outcomes being modeled. These could include factors such as sales growth rates, pricing trends, operating expenses, capital expenditures, and macroeconomic indicators.

Choose Modeling Approach: Select the appropriate modeling approach based on the objectives and complexity of the analysis. Common modeling techniques include spreadsheet-based modeling (using Excel or Google Sheets), specialized financial modeling software, or programming languages like Python or R.

Organize Data and Assumptions: Organize the data and assumptions in a structured manner to ensure clarity and transparency. Use separate tabs or sections within the spreadsheet to differentiate between historical data, assumptions, calculations, and outputs.

Construct the Model:

a. Start with Historical Data: Input historical financial data into the model, including revenue, expenses, assets, liabilities, and cash flows. Ensure accuracy and consistency by cross-referencing data with source documents.

b. Build Revenue Forecast: Develop a revenue forecast based on historical trends, market analysis, and business projections. Consider factors such as market demand, pricing strategy, sales channels, and seasonality.

c. Estimate Expenses: Estimate operating expenses, including cost of goods sold, selling and administrative expenses, research and development costs, and other overhead expenses. Use historical expense ratios or industry benchmarks to guide estimates.

d. Project Cash Flows: Project cash flows by integrating revenue forecasts and expense estimates with cash flow drivers such as working capital requirements, capital expenditures, debt service, and taxes.

e. Incorporate Sensitivity Analysis: Conduct sensitivity analysis to assess the impact of different scenarios and variables on financial outcomes. This involves adjusting key assumptions (e.g., sales growth rate, discount rate) to evaluate the model’s sensitivity to changes.

Validate and Debug: Validate the model by comparing its outputs with historical data, industry benchmarks, or independent forecasts. Debug any errors or inconsistencies in calculations, formulas, or data inputs.

Document Assumptions and Methodology: Document all assumptions, methodologies, and formulas used in the model to provide transparency and facilitate understanding by stakeholders. Include clear explanations and annotations to guide users through the model’s structure and logic.

Test Model Robustness: Test the model’s robustness by stress-testing key assumptions and scenarios to assess its resilience to changing conditions or unexpected events. Ensure that the model produces reasonable and plausible results across a range of scenarios.

Review and Iterate: Review the model with stakeholders, gather feedback, and iterate as necessary to refine the model and improve its accuracy, relevance, and usability.

Tips for Organizing Data Effectively and Ensuring Scalability:

- Use clear and consistent naming conventions for cells, ranges, tabs, and variables to enhance readability and maintainability.

- Structure the model logically, with separate sections for inputs, calculations, outputs, and supporting documentation.

- Break complex calculations into smaller, manageable steps to improve clarity and reduce errors.

- Incorporate error-checking mechanisms such as data validation, conditional formatting, and error alerts to identify and correct potential errors.

- Design the model with scalability and adaptability in mind, allowing for easy expansion, modification, and customization as business needs evolve.

- Document assumptions, methodologies, and formulas comprehensively to facilitate understanding, troubleshooting, and auditing.

- Regularly review and update the model to ensure it remains accurate, relevant, and aligned with changing business conditions and objectives.

By following these steps and tips, you can build a robust and reliable financial model that supports informed decision-making and drives business success.

If You Are Looking For Professional Bookkeeping Services, Please Contact Us At Admin@Entikis.Com And 817-415-1715 To Learn More About How Entikis Bookkeeping Can Support Your Journey To Success! Located At 640 Taylor St Suite , Fort Worth, TX, United States, Texas. We Offer Professional Bookkeeping Services For Businesses In The Burleson, Fort Worth And The Surrounding Tarrant County Metroplex.