Adjusting entries are a crucial aspect of accrual accounting, ensuring that financial statements accurately reflect the financial position of a company at the end of an accounting period. These entries are necessary to record transactions that have occurred but haven’t been officially documented yet or to correct errors in the accounting records. Let’s delve into some of the best tips for making adjusting entries effectively.

Understanding the Purpose of Adjusting Entries

Adjusting entries serve two main purposes:

Accruals: Recording revenues and expenses in the period in which they are earned or incurred, regardless of when cash is exchanged. This ensures that financial statements reflect the company’s true financial position.

Deferrals: Recognizing revenues and expenses that have been received or paid but have not yet been earned or incurred. This helps prevent misrepresentation of the company’s financial performance.

Accruals: Recognizing Economic Events

Accrual accounting aims to match revenues with expenses in the period in which they are incurred, rather than when cash is exchanged. Accruals ensure that financial statements accurately reflect the company’s financial position by capturing all economic events, regardless of when cash transactions occur.

For example, consider a consulting firm that provides services to a client in December but doesn’t receive payment until January. Without accrual accounting, the revenue would be recognized in January when the cash is received, misrepresenting the firm’s performance in December. By making an adjusting entry to recognize the revenue in December, the financial statements reflect the true economic activity of the period.

Accruals also apply to expenses. Suppose the consulting firm incurs expenses for office supplies in December but doesn’t pay the supplier until January. Without accrual accounting, the expense would be recognized in January when the payment is made, inaccurately reflecting the firm’s operating expenses in December. Adjusting entries ensure that expenses are recognized in the period in which they are incurred, providing a more accurate picture of the firm’s financial performance.

Deferrals: Timing of Cash Flows

Deferrals involve recognizing revenues and expenses that have been received or paid but have not yet been earned or incurred. This helps prevent misrepresentation of the company’s financial performance by ensuring that revenues and expenses are recorded in the appropriate accounting period.

For example, consider a magazine publisher that receives payment for annual subscriptions in advance. Without deferral accounting, the entire subscription revenue would be recognized in the period in which it is received, potentially distorting the company’s financial performance if the subscriptions extend into future periods. By making an adjusting entry to defer a portion of the subscription revenue to future periods, the financial statements reflect the timing of the company’s obligations to provide services to its customers.

Similarly, deferral accounting applies to prepaid expenses, such as insurance premiums or rent payments made in advance. These expenses are initially recorded as assets but are gradually expensed over the periods to which they relate. Adjusting entries ensure that the expenses are recognized in the periods in which they are incurred, providing a more accurate representation of the company’s financial position and performance.

In summary, accruals and deferrals play crucial roles in ensuring that financial statements accurately reflect the economic events of a company’s operations. By recognizing revenues and expenses in the periods in which they are earned or incurred, regardless of when cash is exchanged, adjusting entries provide stakeholders with reliable information about the company’s true financial position and performance.

Accrued Revenues

Accrued revenues represent income that has been earned but not yet received or recorded. These revenues typically arise when services are performed or goods are delivered to customers, but payment has not yet been received. Adjusting entries are necessary to recognize accrued revenues in the accounting period in which they are earned, ensuring that financial statements accurately reflect the company’s performance.

For example, consider a construction company that completes a project in December but does not bill the client until January. Despite not receiving payment, the company has earned revenue for the services rendered in December. To reflect this accurately, the company makes an adjusting entry at the end of December to recognize the accrued revenue.

Accrued revenues are typically recorded as a credit to a revenue account and a corresponding debit to an asset account, such as accounts receivable or a revenue receivable account. Once the payment is received, the accounts receivable balance is reduced, and cash is increased accordingly.

Accrued Expenses

Accrued expenses are costs that have been incurred but not yet paid or recorded. These expenses arise when goods or services are received, but payment has not yet been made. Adjusting entries are required to recognize accrued expenses in the accounting period in which they are incurred, ensuring that expenses are matched with the revenues they help generate.

For instance, suppose a company receives utility services in December but does not receive the bill until January. Despite not making the payment, the company has incurred expenses for the utilities used in December. To accurately reflect this, the company makes an adjusting entry at the end of December to recognize the accrued expense.

Accrued expenses are typically recorded as a debit to an expense account and a corresponding credit to a liability account, such as accounts payable or a accrued expenses payable account. Once the payment is made, the accounts payable balance is reduced, and cash is decreased accordingly.

Prepaid Expenses

Prepaid expenses are costs that have been paid in advance but have not yet been used or consumed. These expenses typically represent future benefits that will be realized over time. Adjusting entries are necessary to recognize the portion of the prepaid expense that has been used up during the accounting period, ensuring that expenses are matched with the revenues they help generate.

For example, suppose a company pays rent for the next six months in advance. The entire rent payment is initially recorded as a prepaid expense. However, at the end of each month, an adjusting entry is made to recognize the portion of the rent expense that corresponds to that month’s usage.

Prepaid expenses are typically recorded as an asset on the balance sheet and expensed over time as they are consumed or used. Adjusting entries for prepaid expenses involve debiting an expense account and crediting the prepaid expense account to reduce its balance.

Unearned Revenues

Unearned revenues, also known as deferred revenues or prepaid revenues, represent payments received from customers for goods or services that have not yet been provided. These revenues are recorded as liabilities until the company fulfills its obligations to the customer. Adjusting entries are necessary to recognize the portion of the unearned revenue that has been earned during the accounting period, ensuring that revenues are matched with the expenses they help generate.

For instance, consider a company that receives payment in advance for a magazine subscription. The payment is initially recorded as unearned revenue since the company has not yet delivered the magazines to the customer. However, as each magazine is delivered, an adjusting entry is made to recognize the portion of the subscription revenue that corresponds to the magazines delivered.

Unearned revenues are recorded as liabilities on the balance sheet until they are earned. Adjusting entries for unearned revenues involve debiting a liability account and crediting a revenue account to recognize the revenue that has been earned.

In summary, adjusting entries play a crucial role in accurately reflecting a company’s financial position and performance. By properly recognizing accrued revenues and expenses, prepaid expenses, and unearned revenues, companies can ensure that their financial statements provide a true representation of their operations and help stakeholders make informed decisions.

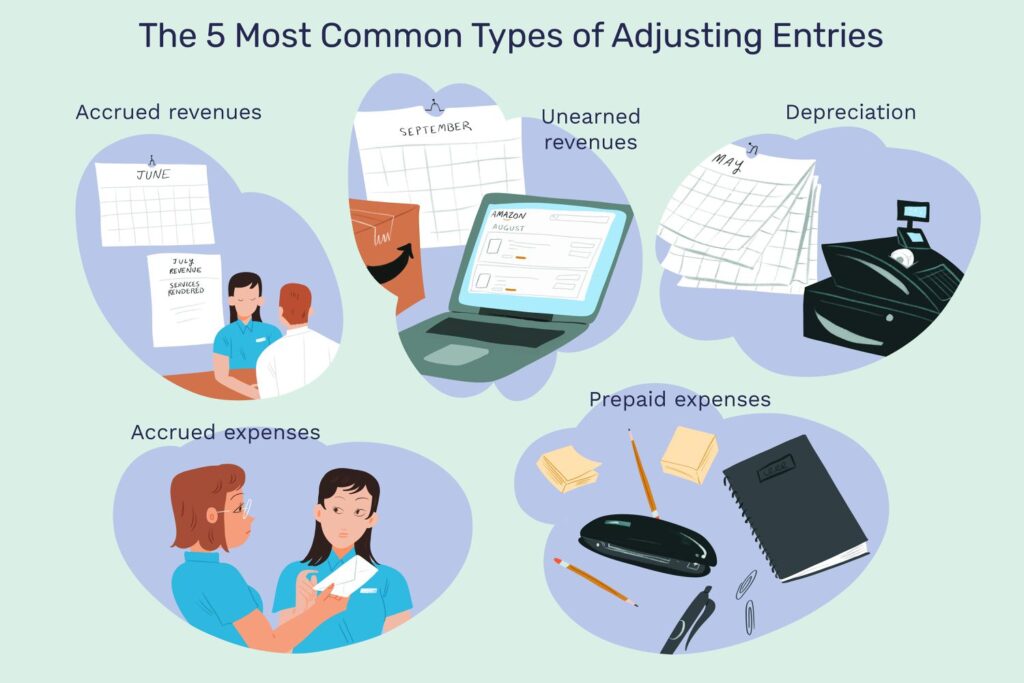

Types of Adjusting Entries

Adjusting entries can be classified into four main types:

Accrued Revenues: These are revenues that have been earned but not yet recorded. Adjusting entries are made to recognize these revenues.

Accrued Expenses: These are expenses that have been incurred but not yet recorded. Adjusting entries are made to recognize these expenses.

Prepaid Expenses: These are expenses that have been paid in advance but haven’t been used yet. Adjusting entries are made to recognize the portion of the prepaid expense that has been used up during the accounting period.

Unearned Revenues: These are revenues that have been received in advance but haven’t been earned yet. Adjusting entries are made to recognize the portion of the unearned revenue that has been earned during the accounting period.

Tips for Making Adjusting Entries

Review Transactions: Before making adjusting entries, thoroughly review all transactions for the accounting period. This ensures that all relevant transactions are accounted for and that adjusting entries are made accurately.

Use Reversing Entries: Consider using reversing entries for certain adjusting entries, especially those related to accruals. Reversing entries can simplify the accounting process for the subsequent period.

Document Everything: Keep detailed documentation of all adjusting entries made, including the rationale behind each entry. This documentation is essential for audit purposes and helps maintain transparency in the accounting process.

Allocate Expenses Appropriately: When allocating expenses, ensure that they are distributed accurately between different accounting periods. Use estimates or other methods as necessary to allocate expenses that span multiple periods.

Consider Materiality: When deciding whether to make adjusting entries for certain transactions, consider the materiality of the transactions. Focus on transactions that have a significant impact on the financial statements and prioritize those for adjustment.

Stay Compliant: Ensure that all adjusting entries comply with accounting standards and regulations. This helps maintain the integrity of the financial statements and reduces the risk of non-compliance issues.

Reconcile Accounts: Reconcile accounts before making adjusting entries to identify any discrepancies or errors that need to be corrected. This ensures that adjusting entries are based on accurate account balances.

Use Accounting Software: Utilize accounting software to streamline the process of making adjusting entries. Accounting software can automate certain tasks and provide built-in checks and balances to help ensure accuracy.

Involve Stakeholders: Involve relevant stakeholders, such as management or department heads, in the process of making adjusting entries. This promotes transparency and ensures that all parties are aware of any adjustments made.

Review Financial Statements: Review the financial statements after making adjusting entries to ensure that they accurately reflect the financial position and performance of the company. Make any necessary adjustments or corrections as needed.

The Importance of Adjusting Entries

Adjusting entries serve as the bridge between the accrual basis of accounting and the cash basis, ensuring that financial statements accurately reflect the economic reality of a company’s transactions. They are essential for several reasons:

Accurate Financial Reporting: Adjusting entries help align revenue and expenses with the period in which they are earned or incurred, rather than when cash is received or paid. This ensures that financial statements provide a true representation of the company’s financial performance during the accounting period.

Decision Making: Stakeholders, including investors, creditors, and management, rely on financial statements to make informed decisions about the company. Adjusting entries ensure that these decisions are based on accurate and reliable information, contributing to the overall trust and confidence in the organization.

Compliance: Adhering to accounting standards and regulations is paramount for any business. Adjusting entries help ensure compliance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the reporting requirements of the company.

Preventing Misstatements: Failure to make adjusting entries can lead to misstatements in the financial statements, which can mislead stakeholders and result in erroneous business decisions. Adjusting entries help prevent such misstatements by capturing all relevant transactions and events that occurred during the accounting period.

Transparent Financial Reporting: Transparent financial reporting is essential for building trust with stakeholders. Adjusting entries, along with thorough documentation and disclosure, demonstrate the company’s commitment to transparency and integrity in its financial reporting practices.

Audits and Reviews: During audits or reviews by external parties, such as auditors or regulatory agencies, adjusting entries provide supporting evidence of the accuracy and reliability of the financial statements. Properly documented adjusting entries facilitate the audit process and help ensure a smooth examination of the company’s financial records.

Continuous Improvement: The process of making adjusting entries encourages ongoing review and analysis of financial data, leading to continuous improvement in accounting practices. By identifying areas for improvement or correction, accountants can enhance the accuracy and efficiency of financial reporting over time.

In summary, adjusting entries are vital for ensuring the accuracy, reliability, and transparency of financial statements. By understanding their importance and adhering to best practices in making them, accountants contribute to the overall integrity of the accounting process and provide stakeholders with the information they need to make informed decisions.

If You Are Looking For Professional Bookkeeping Services, Please Contact Us At Admin@Entikis.Com And 817-415-1715 To Learn More About How Entikis Bookkeeping Can Support Your Journey To Success! Located At 640 Taylor St Suite , Fort Worth, TX, United States, Texas. We Offer Professional Bookkeeping Services For Businesses In The Burleson, Fort Worth And The Surrounding Tarrant County Metroplex.